Reading Time: 3 minutes

Reading Time: 3 minutesIntroduction

The accuracy of credit risk assessment stands as a critical pillar for the sustenance and growth of financial institutions. Traditionally, these assessments were heavily reliant on historical data and human judgment, a method that, while serviceable, has shown its limitations in the face of rapidly changing market conditions and the advent of complex financial instruments. The need for a more agile, data-driven approach has never been more pressing.

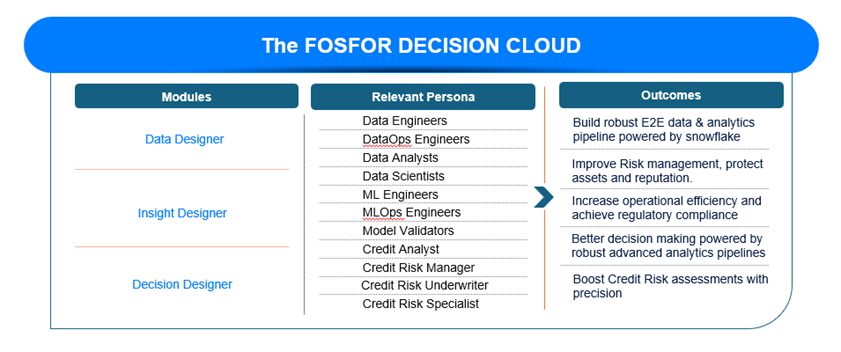

Enter the Fosfor Decision Cloud (FDC). A platform that represents the zenith of innovation in the realm of credit risk analytics, the FDC offers something the industry has never had before. With its modular design, which covers the entire data-to-decisions journey, FDC is not just a tool but a comprehensive ecosystem that empowers financial institutions to navigate the intricacies of credit risk with unprecedented precision and adaptability.

The evolution from traditional models

Historically, credit risk assessment methodologies have leaned heavily on static data points like credit scores and financial histories. These models, though foundational, offer a narrow view, often overlooking nuanced, dynamic factors such as market trends or consumer behaviour changes. Moreover, the manual nature of these assessments introduces a substantial margin for error and bias, compromising the reliability of the analysis.

In an era defined by volatility and rapid information flow, these traditional models struggle to keep pace. The resulting lag not only hampers decision-making but can also lead to missed opportunities and increased exposure to risk, highlighting a clear need for a paradigm shift in how financial institutions approach credit risk assessment.

The Fosfor Decision Cloud

The Fosfor Decision Cloud (FDC)is an end-to-end, comprehensive decision intelligence platform designed to facilitate the entire data-to-decision process in Credit Risk Analytics. This platform seamlessly integrates data management, AI-driven analytics, and decision intelligence techniques, empowering Credit Analysts, Credit Underwriters, and Credit Risk managers with actionable insights and precision credit risk assessments.

Each module of the FDC empower users to make robust and sound decisions with tools and features that simplify the data-to-decisions journey.

Data Designer: The foundation for insights

At the heart of the Fosfor Decision Cloud’s transformative power is the Data Designer. This innovative tool transcends traditional data collection and processing methods by leveraging the robust capabilities of Snowflake for seamless data integration and management. Financial institutions can now easily aggregate and harmonize data from disparate sources, ensuring a holistic view of credit risk that captures both macroeconomic indicators and micro-level consumer behaviors.

With Data Designer, the erstwhile cumbersome process of data preparation is simplified, enabling analysts to focus on deriving actionable insights faster rather than wrestling with data integrity issues. This foundational module not only optimizes the accuracy of credit risk assessments but also significantly reduces the time required to process and analyze vast amounts of information, marking a monumental leap forward from traditional practices.

Insight Designer: The future of analytics

The Insight Designer of the Fosfor Decision Cloud serves as the intellectual epicentre where data is transformed into actionable intelligence. It helps enterprises build, train, deploy, and manage AI models at enterprise scale. It is a centralized, scalable, and collaborative environment for building your ML/DL/Large Language Models using your language and IDE of choice. It takes care of technical infrastructure and scalability thanks to auto scaling, on-demand resource allocation, distributed computing, in-database analytics, and support for both GPU and distributed training frameworks.

Whether it’s pinpointing emerging market trends or uncovering potential vulnerabilities within a credit portfolio, the Insight Designer empowers users with the foresight needed to navigate the complex landscape of financial risk management effectively.

Decision Designer: The art of precision

The final piece of the Fosfor Decision Cloud trinity, the Decision Designer is where strategic vision comes to fruition. This module enables financial institutions to operationalize the insights gleaned from the Insight Designer, translating complex data patterns into concrete, automated decision-making workflows.

From setting more accurate credit limits to tailoring financial products to meet the evolving needs of the market, the Decision Designer offers a versatile toolkit for instituting data-driven decisions across the credit lifecycle. By integrating predictive analytics and scenario modeling, this module not only enhances the precision of credit risk assessment but also equips institutions with the agility to adapt strategies in real-time, a critical capability in today’s evolving financial environment.

Conclusion

The arrival of the Fosfor Decision Cloud marks a pivotal moment in the evolution of credit risk analytics. By harmonizing data, insights, and decisions under one roof, the FDC offers a holistic, modular solution that addresses the multifaceted challenges of credit risk assessment in the modern financial landscape.

With its Snowflake-powered backend ensuring seamless data management, the FDC not only streamlines the analytical process but also elevates the accuracy and relevance of credit risk assessments to unprecedented levels. The integration of such advanced technologies in credit risk analytics promises not only enhanced operational efficiency for financial institutions but also a more robust, resilient financial system that can better serve the needs of a rapidly changing world.