Reading Time: 5 minutes

Reading Time: 5 minutesConsumer Packaged Goods (CPG) companies, rarely have visibility of their market, competitors, or selling patterns because they depend on retailers as their end-customer. The presence of retailers in the process of selling CPG products to end consumers creates the need for multiple varied data access for CPG companies. As such, retail audit data provides visibility across product hierarchies, channels and areas. For example, since CPG companies rely on retailer data, they need to utilize their most accurate sources, like household panel data, to understand customer penetration, frequency, etc., across multiple hierarchies. It is of utmost importance for a category manager at a CPG company to analyze these datasets with multiple other datasets like media, leaflets, perfect store, EPOS, etc, and obtain business insights from it.

Analyzing market share: Why is it necessary?

For CPG category managers seeking to improve their sales performance and market share, the quickest route to success is often decoding business insights from category analysis focusing on increasing sales value and market share. This is successful when backed by exceptional product quality, product presence in stock, customer penetration, and share of aisle.

Analyzing market share is an industry-wide challenge impacting multiple functions. It affects the:

- Product

- Rate of sales

- Weighted distribution

- Frequency of customers

- Spend per visit

Considering the differing objectives across functions to derive actionable insights, the market share is often looked at with inter-dependent functional data residing in disparate systems. This departmentalized approach to analysis forces the aggregation of data and information to a very high level.

This limits the ability to:

- Track, trace, and analyze (on a single pane of glass) disparate data in the market share and take business decisions accordingly.

- Quickly identify the root cause of complex systems and increase sales across channels and products.

- Identify the erroneous sub-brands/variations and performances.

- Detect and avoid hurdles in the sales cycle across retailers before they occur.

Fortunately for the business leaders tasked with managing and increasing market share, customer penetration, frequency, and share of aisle, there is hope. It comes in the form of Decision Intelligence platforms like Fosfor Lumin.

The data

This blog post presents Lumin’s capability to analyze the category sales data for a global CPG company. Capacities of Lumin by Fosfor include:

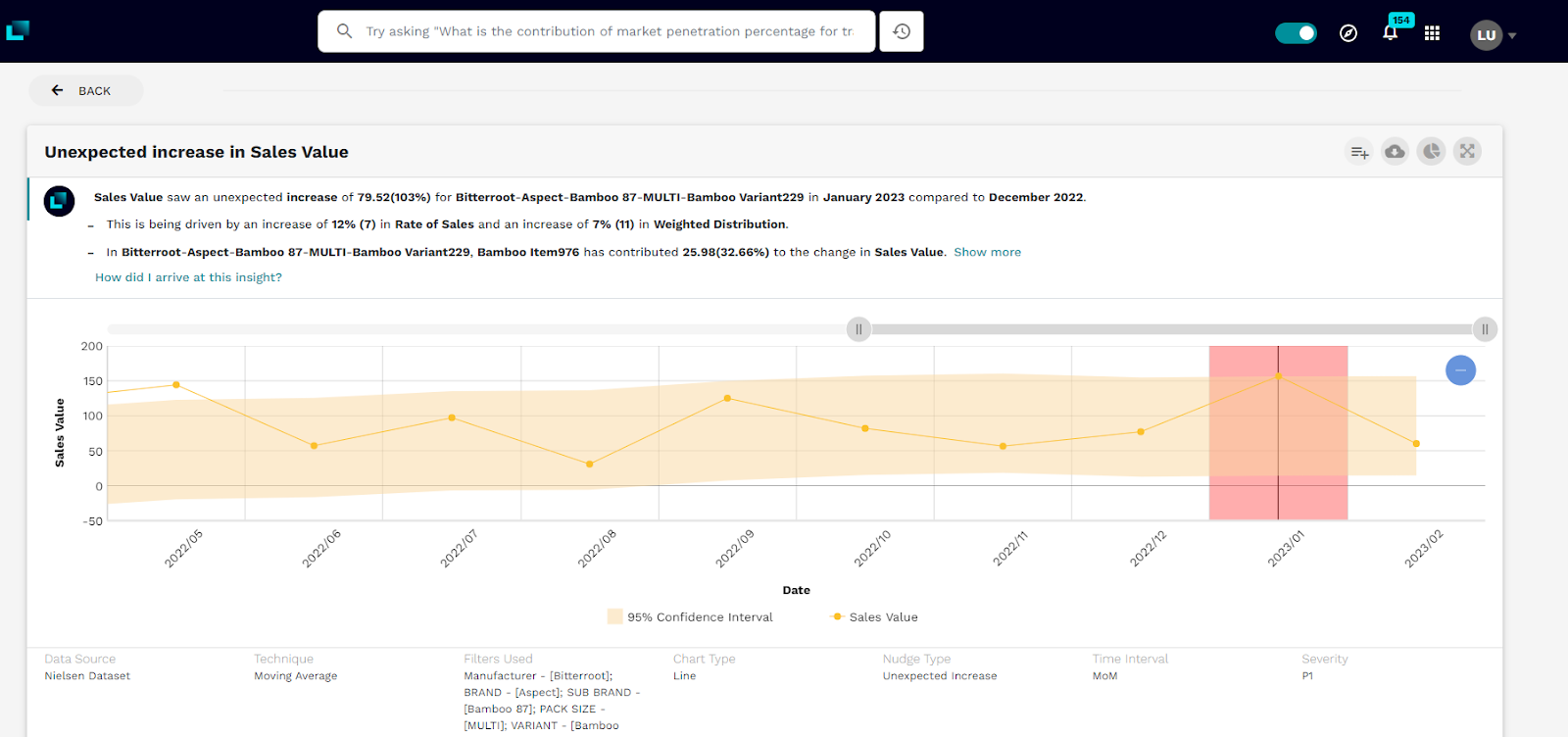

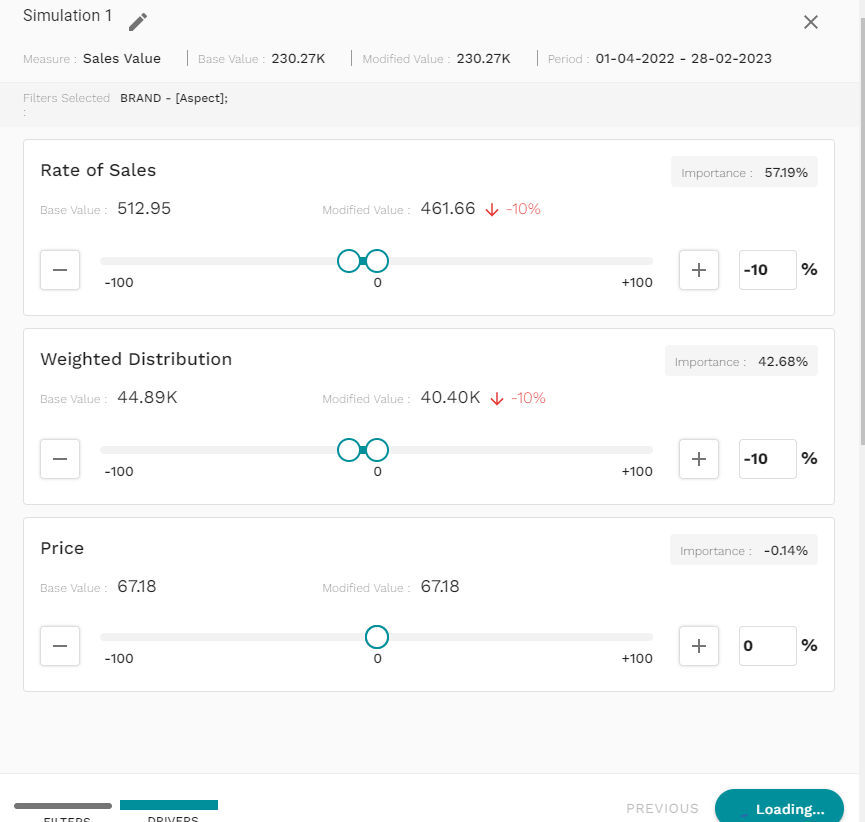

- Proactively identifying anomalistic trends in sales value and subsequent diagnosis across channels, product hierarchy, pack type, variant, etc.

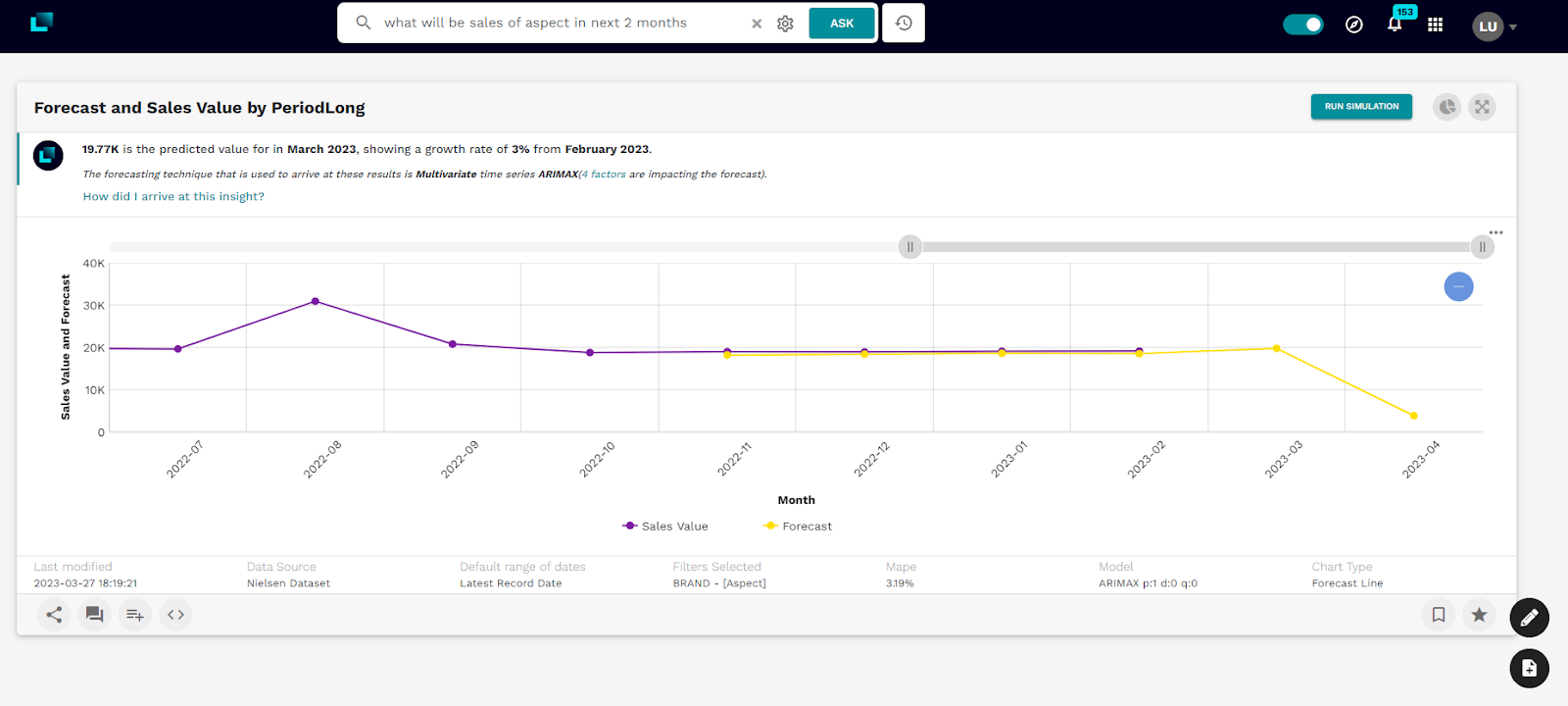

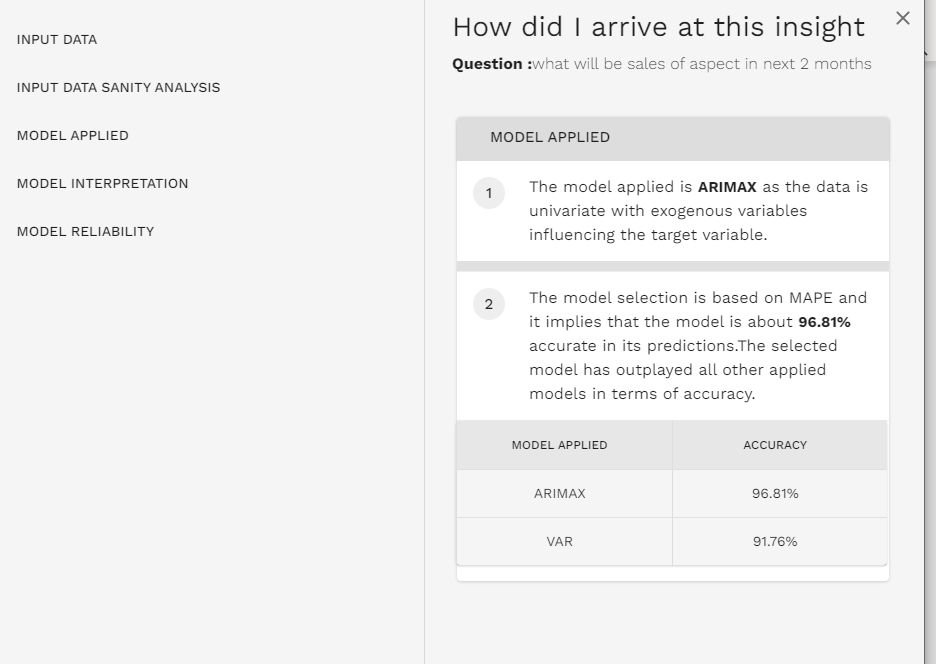

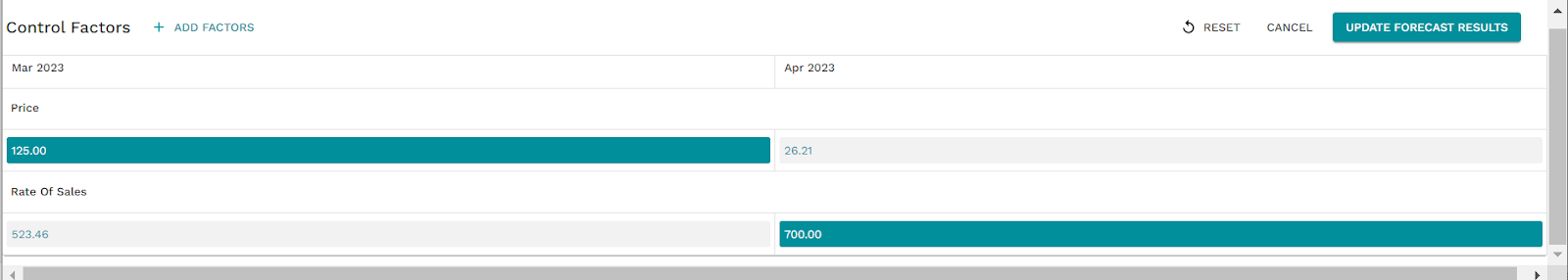

- Identification of the market share drivers and simulation of their impact on sales.

- Accurate prediction of the overall sales through multivariate forecasting.

Our dummy data consists of retail audits, household panels, and multiple internal data sources, i.e., EPOS system and the perfect store system. This data will be hosted on a cloud data warehouse (AWS Redshift) as virtualized views or reflections. The data’s schema consists of monthly market share data across different attributes. Key attributes include:

- Key dimensions: Product type, pack type manufacturer, brand, sub-brand, pack size, variant, retailer, trade, etc.

- Key measures: Market share, sales value, share of aisle, etc.

- Date dimension: Audit dates

Descriptive analytics to help CPG companies explore the market share data

Let’s explore the data for the market share by brands in February 2023. We will start with a simple descriptive analysis by asking a few questions below.

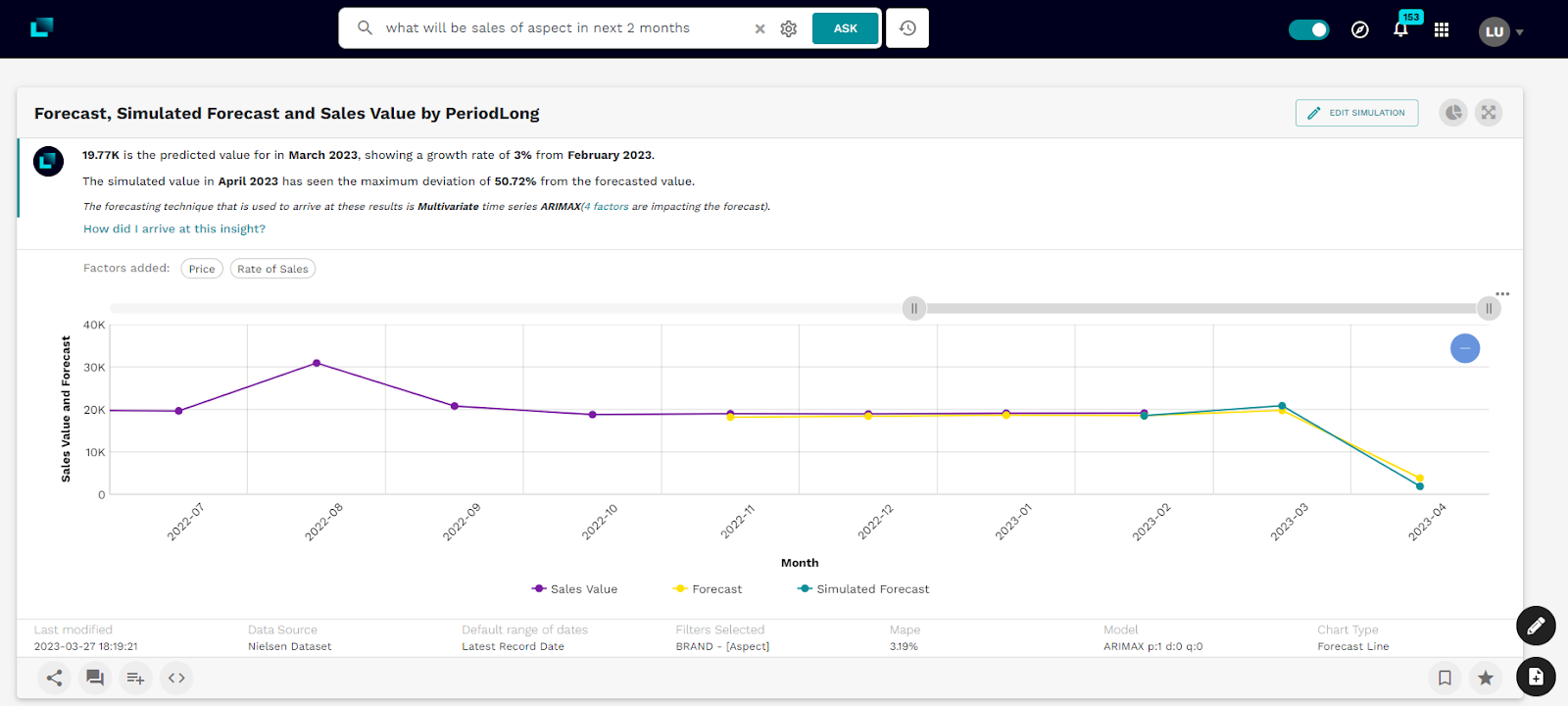

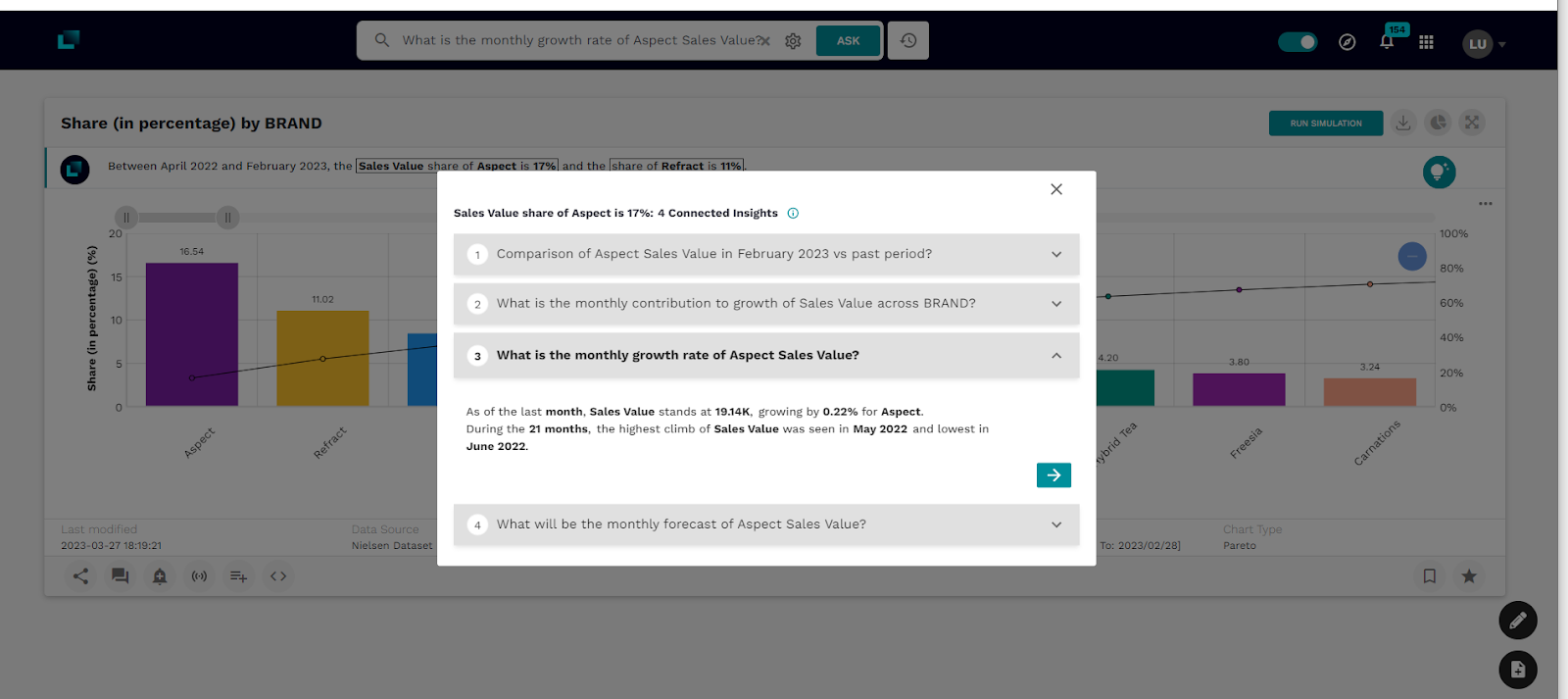

What is the share of sales by brands?

Image 1: Share of sales

Image 1: Share of sales

Fosfor Lumin understood our question in natural language and converted it into an analytical query along with the time filter. Lumin clearly calls out in Image 1 that Aspect is the market leader with the majority market share. It would be interesting to understand its spread across the different time frames. As a business, taking business decisions by looking out for sales value trends and understanding growth rates is essential.

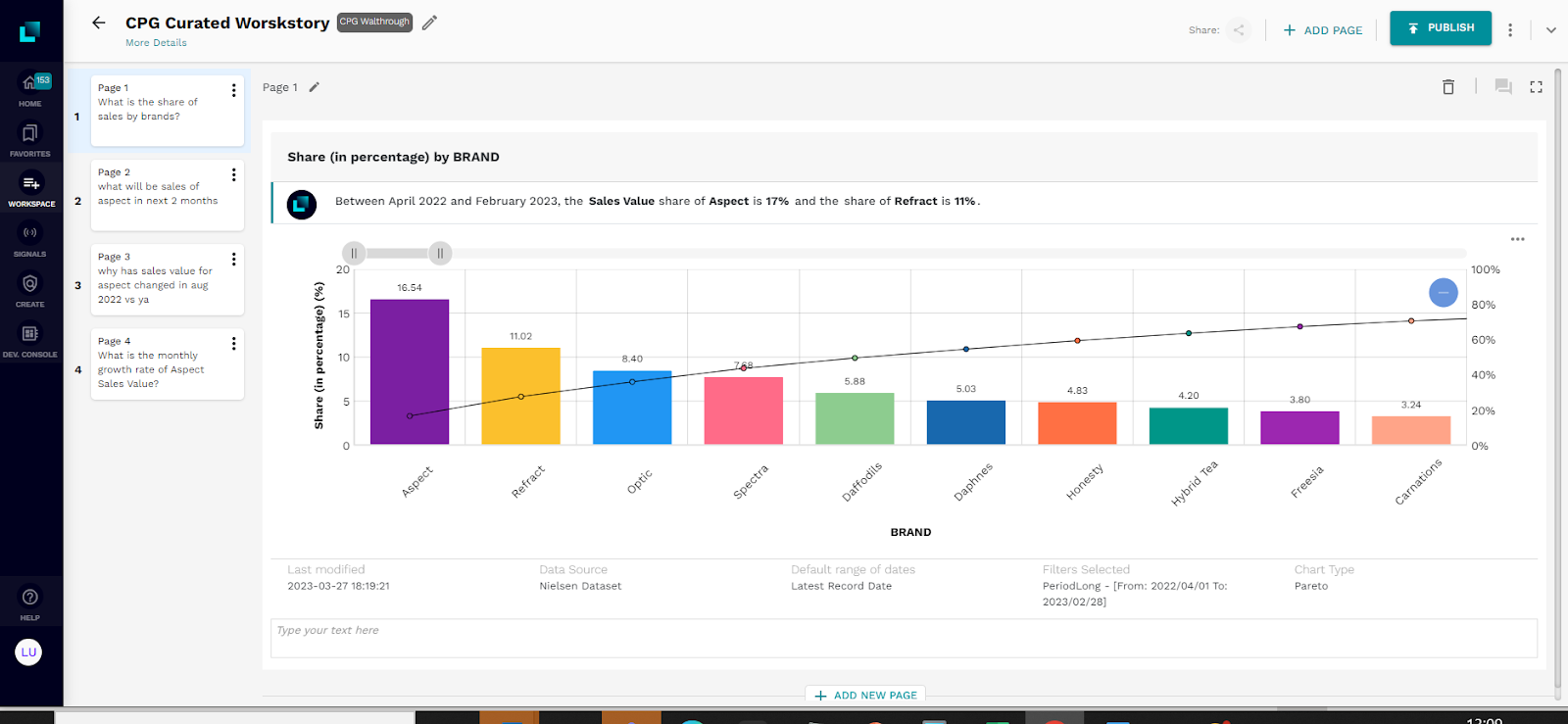

By clicking the connected insights button, Lumin provides a set of simple and advanced analytical questions closely related to the metric or KPI being explored. Connected insights also suggest the growth rate in Lumin.

Image 2: Connected decision insights

Image 2: Connected decision insights

As the next logical step, as seen in Image 2, it would be prudent to identify the trend where the highest share in sales has been observed. We ask Lumin this next question.

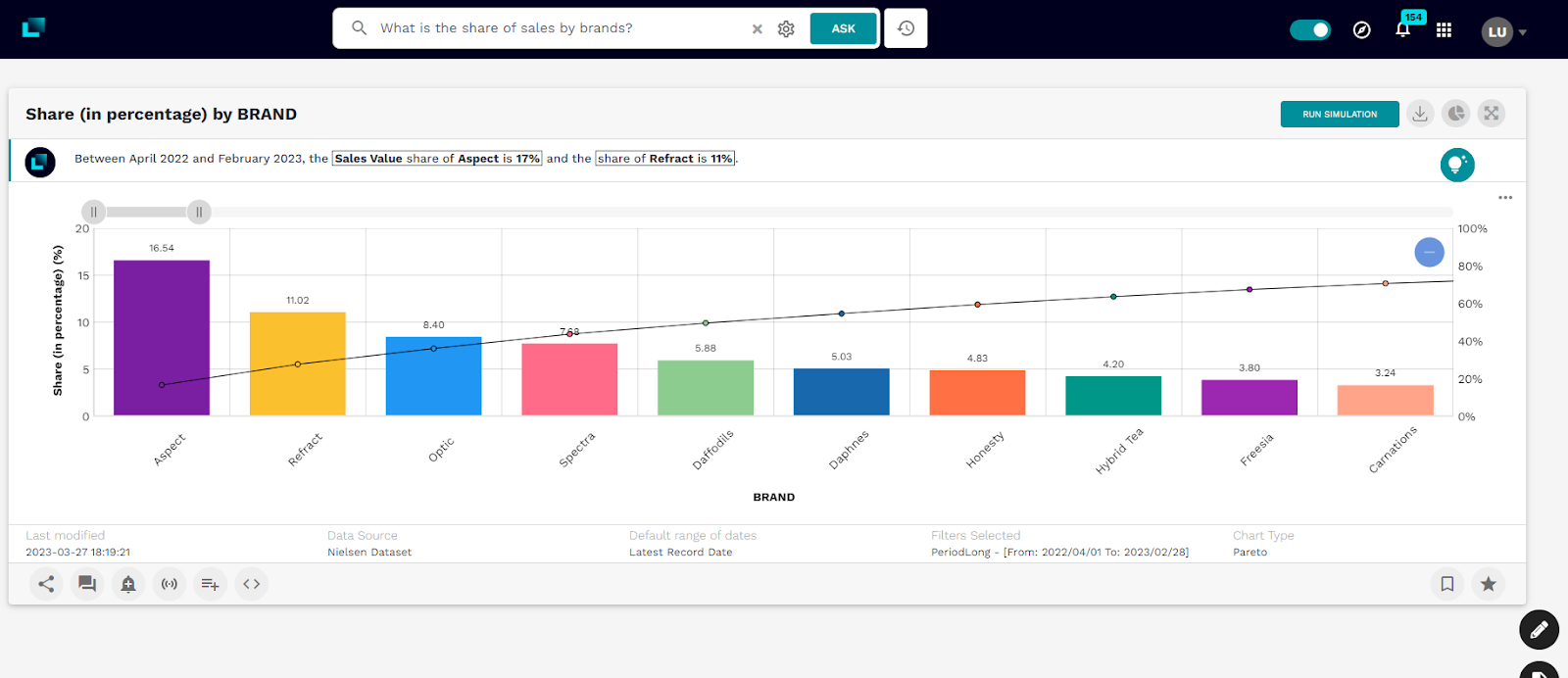

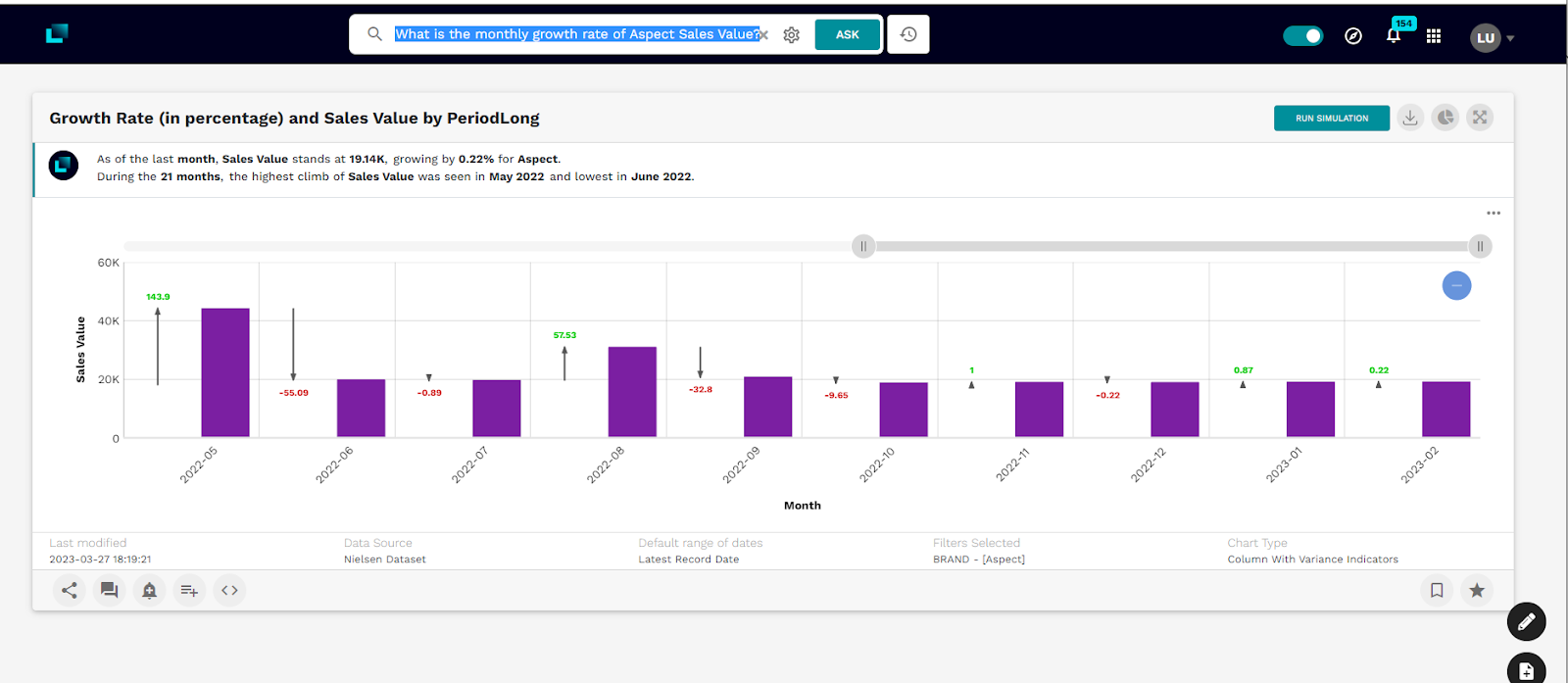

What is the monthly growth rate of Aspect’s sales value?

Image 3: Growth rate of Aspect. This Image also highlights a few features of Lumin viz, data export, chart switcher and download data

Image 3: Growth rate of Aspect. This Image also highlights a few features of Lumin viz, data export, chart switcher and download data

It is worth noting that Lumin also allows to:

- Export the underlying data

- Flexibility to switch the chart visualization

As you can see in Image 3, Fosfor Lumin dynamically selected the best-fit visualization to present the insight while also generating a contextualized narrative (in English) to explain the same. It is evident that August 2022 has shown a huge increase in sales. This information is interesting because it allows users to understand what drives this increase and from when. Since August has witnessed growth, why not explore the different pack sizes that contributed most to this outcome?

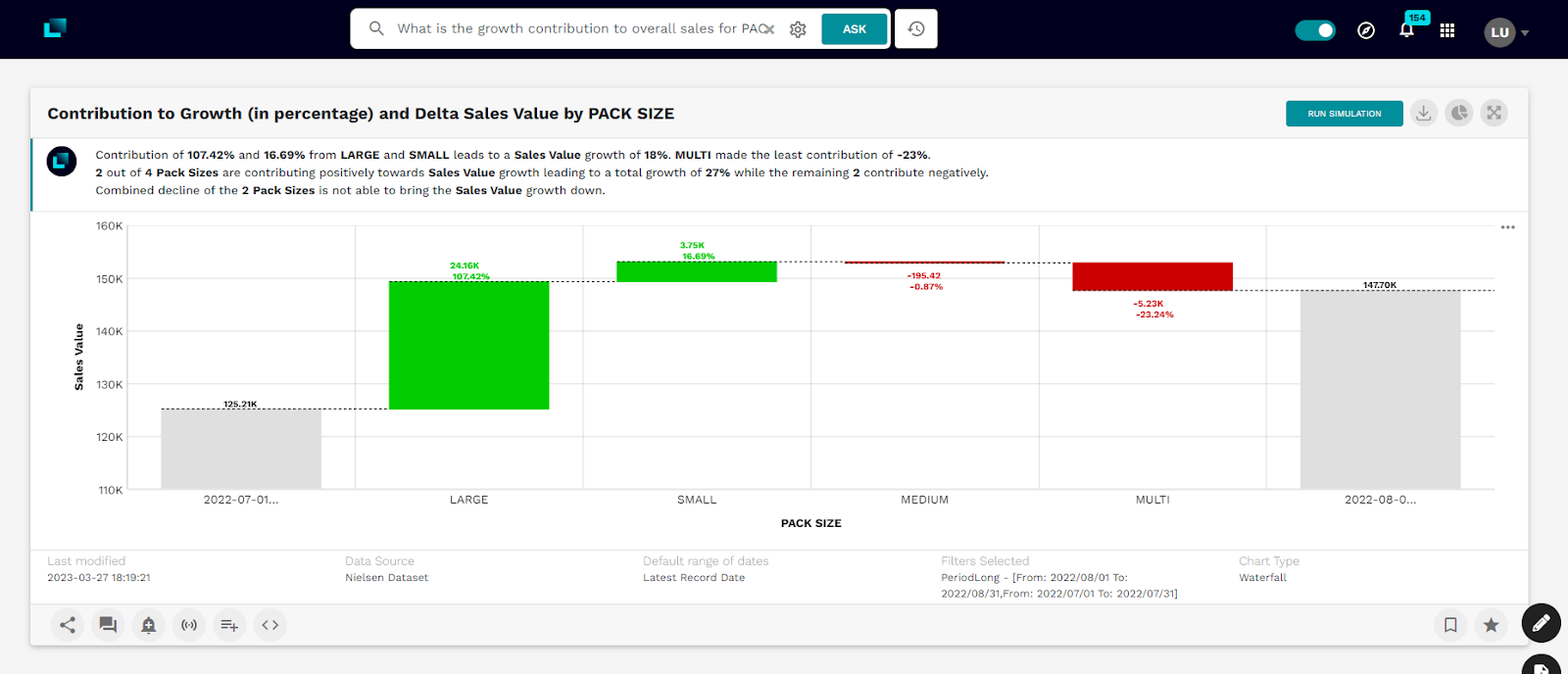

What is the growth contribution to overall sales for pack size in September 2022?

Lumin provides users with some powerful collaboration features to do the following:

- Share the business decision insights with our colleagues within the organization.

- Add comments (our understanding, observations, POV, etc.) on the insights while collaborating with a larger team.

- Create personalized alerts and signals to better track the metrics or KPIs. We can get notified when our metrics breach a threshold that we can define.

- Capture the insights in an insights storyboard called a workspace as we go about our exploratory journey. The workspace can further be shared with our colleagues within the organization.

As a collaborating user, I would expect Lumin to show me a waterfall chart. It does exactly that. Lumin’s semantic model understands common business terminologies like ratio, share, contribution, top or bottom N, etc. Furthermore, it does not need to be separately trained on that. As is evident from Image 4, the large pack size has contributed the highest to growth, whereas the multi-pack size negatively impacted it.

Image 4: Waterfall chart to depict the pack size impact on growth distribution in Aug 2022

Image 4: Waterfall chart to depict the pack size impact on growth distribution in Aug 2022

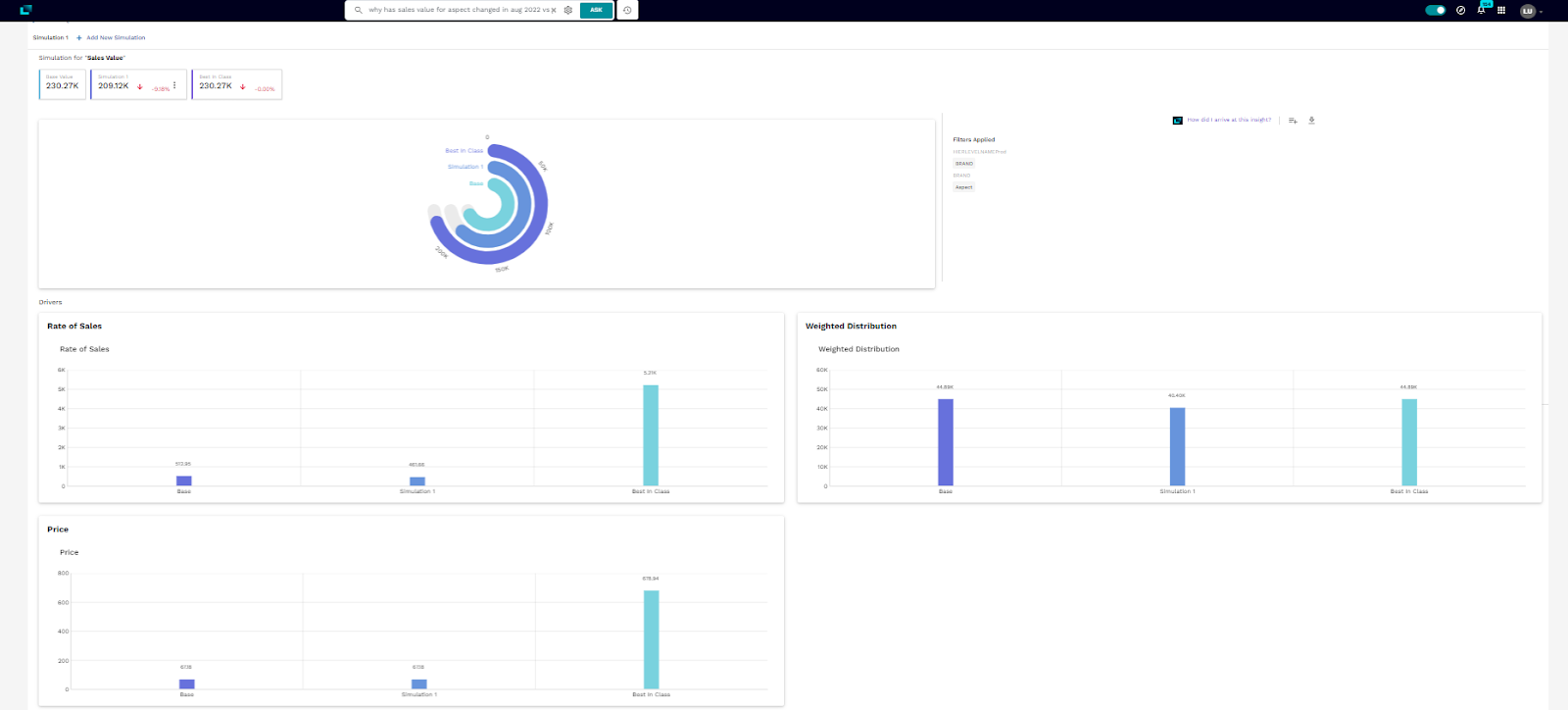

Since we know the greatest change was observed in August 2022, the next obvious question would be: Why has the Sales value for Aspect changed in Aug 2022 vs. a year ago? To answer this, we can ask Lumin the following question.

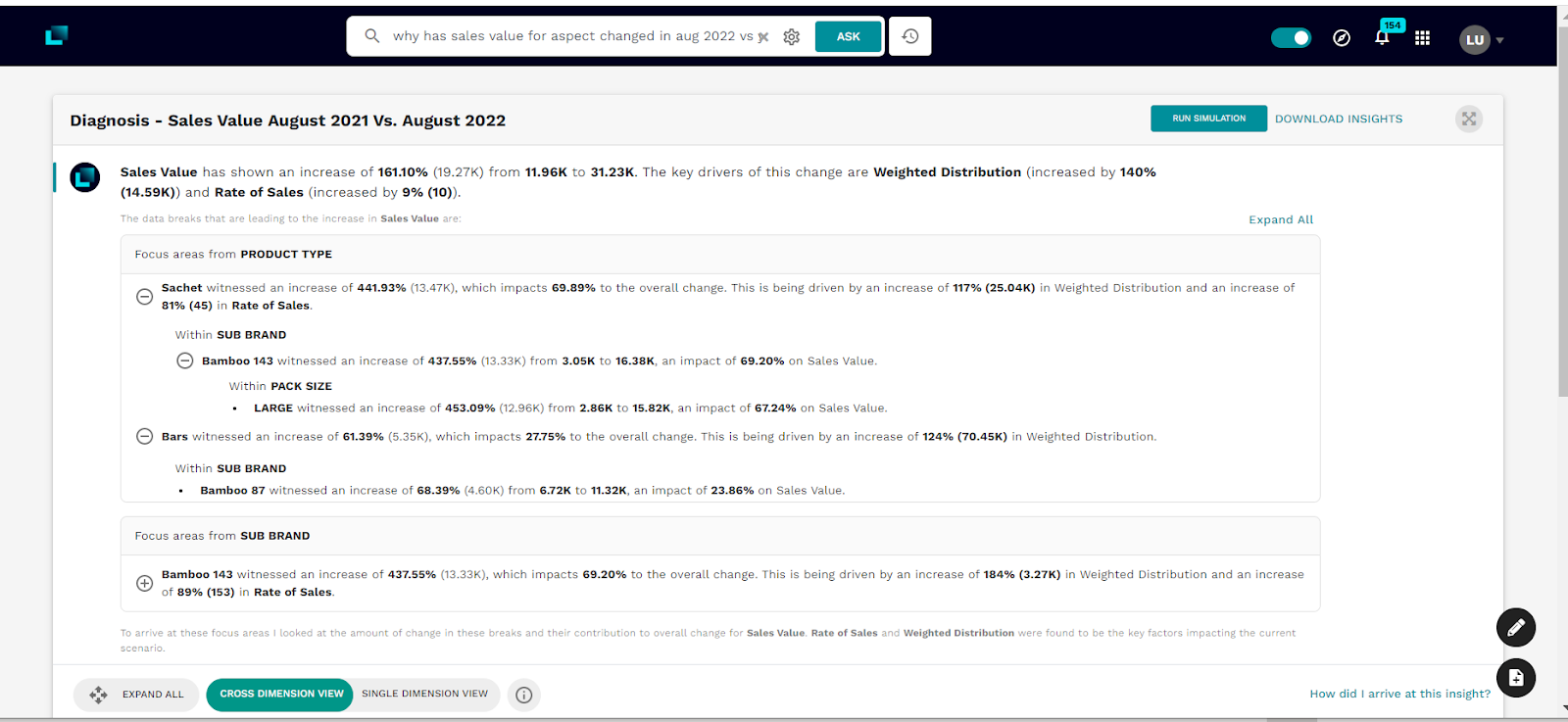

Why has the sales value for Aspect changed in Aug 2022 vs. a year ago?

Image 5: Diagnostic of change in sales in 2022

Image 5: Diagnostic of change in sales in 2022

As seen in Image 5, Lumin – the Decision Intelligence platform, performs a cross-dimensional sales value analysis. This includes the product hierarchy (manufacturer, brand, variant) and product size. It also includes a type apart from the geographical hierarchy, evaluating across channels and trades we have already analyzed. In a matter of a few seconds, Lumin presents a detailed narrative and an interactive bubble chart that presents the deep-dive analysis across multiple levels, like product, manufacturer, and size.

Image 8: Retailer with maximum Change in Share of Aisle for Aspect

Image 8: Retailer with maximum Change in Share of Aisle for Aspect