Reading Time: 7 minutes

Reading Time: 7 minutesFor manufacturers seeking to improve their financial performance and customer satisfaction, the quickest route to success is often a product-quality transformation focusing on reducing warranty costs. When fulfilled while backing exceptional product quality, product warranties positively impact sales, profitability, and customer loyalty. On the other hand, when warranties are backed by sub-optimal products, it results in large warranty reserves that directly impact the organization’s profitability. This negatively impacts the organization’s brand, Image, and equity.

Analyzing warranty claims: Why is it necessary?

Managing warranty claims (and spending) is an organization-wide challenge impacting multiple functions. These include:

- Quality

- Finance

- Product Engineering

- Customer service

- Procurement

- Warranty administration

Considering the disparate objectives across functions, the warranty data is often looked at with inter-dependent functional data residing in disparate systems to derive actionable insights. This departmentalized approach to analysis forces the aggregation of data and information to a very high level. This state limits the ability to:

- Track, trace, and analyze (on a single pane of glass) disparate data in the warranty chain.

- Detect and avoid product failures before they occur.

- Accurately predict warranty cost obligations and reserves.

- Quickly identify the root cause of complex systems and reduce the detection to correction (DTC) time.

- Reduce fraud in the warranty chain.

- Identify the erroneous vendors/suppliers and drive recovery.

Fortunately Lumin’s Decision Intelligence capabilities and Snowflake’s computing prowess can make this task considerably simpler. Decision makers tasked with managing and reducing warranty budgets, product recalls, assessing vendor quality, and supplier financial recovery can obtain critical insights at speed and scale with Lumin’s advanced analytical capabilities and Snowflake’s next generation Data Cloud. The following use case illustrates how a HVAC Manufacturer major can proactively analyse their warranty claims data and get actionable insights directly on their Snowflake Data Cloud. These include:

- Proactively identifying anomalistic trends in sales value and subsequent diagnosis across channels, product hierarchy, pack type, variant, etc.

- Identification of the market share drivers and simulation of their impact on sales.

- Accurate prediction of the overall sales through multivariate forecasting.

The data

The data for this use case consists of multiple internal data sources, viz. warranty and financial management systems, joined together and hosted on a cloud data warehouse (AWS Redshift) as virtualized views or reflections.

The data’s schema consists of daily warranty claims data across 51 different attributes. The key attributes include:

- Key dimensions: Region, country, service center, product, model, warranty part family, causal part code, policy type, claim type, etc.

- Key measures: Warranty spending, part cost, labor cost, number of claims, etc.

- Date dimension: Credit issued date

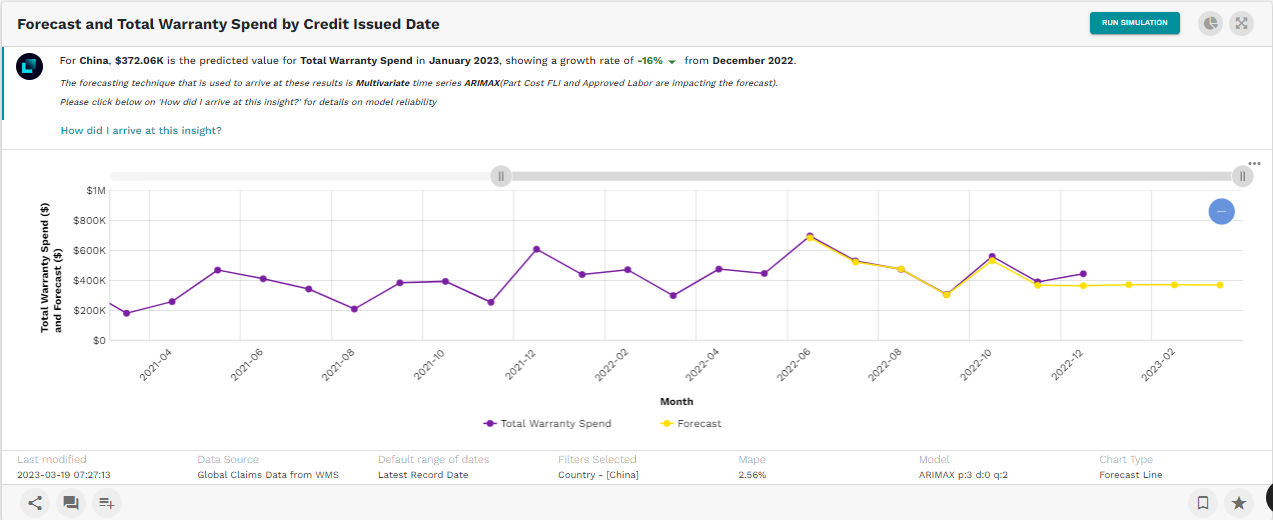

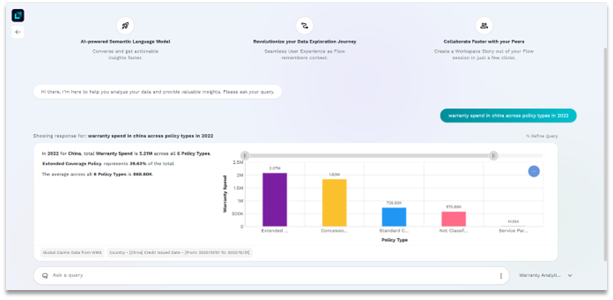

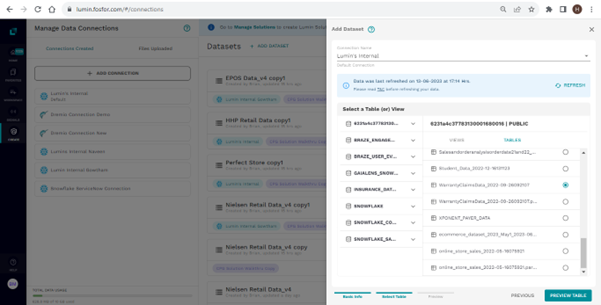

The data for this use case consists of multiple internal data sources, viz. warranty, and financial management systems, joined together and hosted on the Snowflake DWH as virtualized views. These aggregated views are eventually connected via Lumin’s in-built Snowflake connector. (See image 1 below )

Descriptive analytics to help you explore the warranty spending data

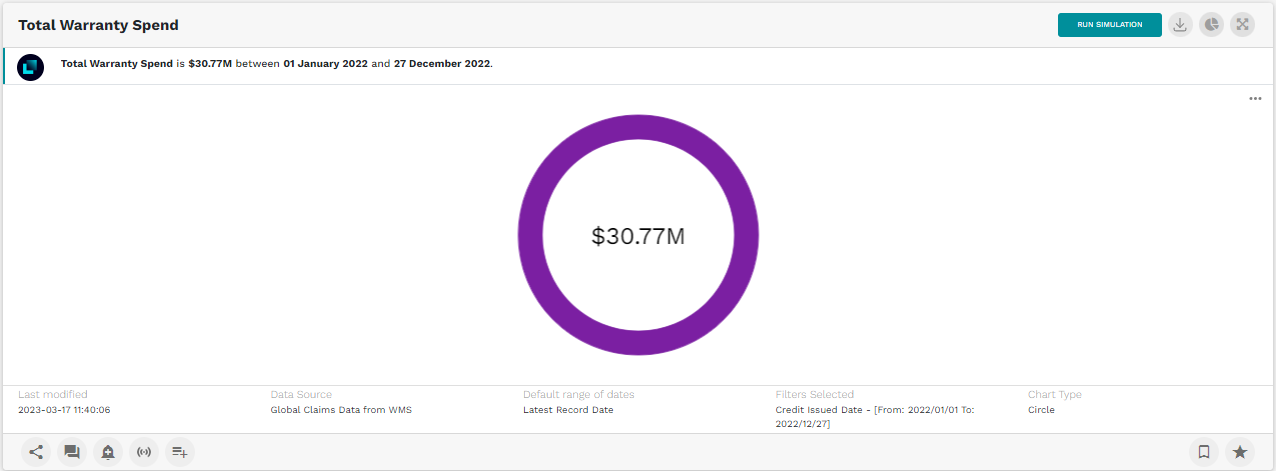

Let us start analyzing warranty spending data for 2022. We will start with a simple descriptive analysis by asking the following question.

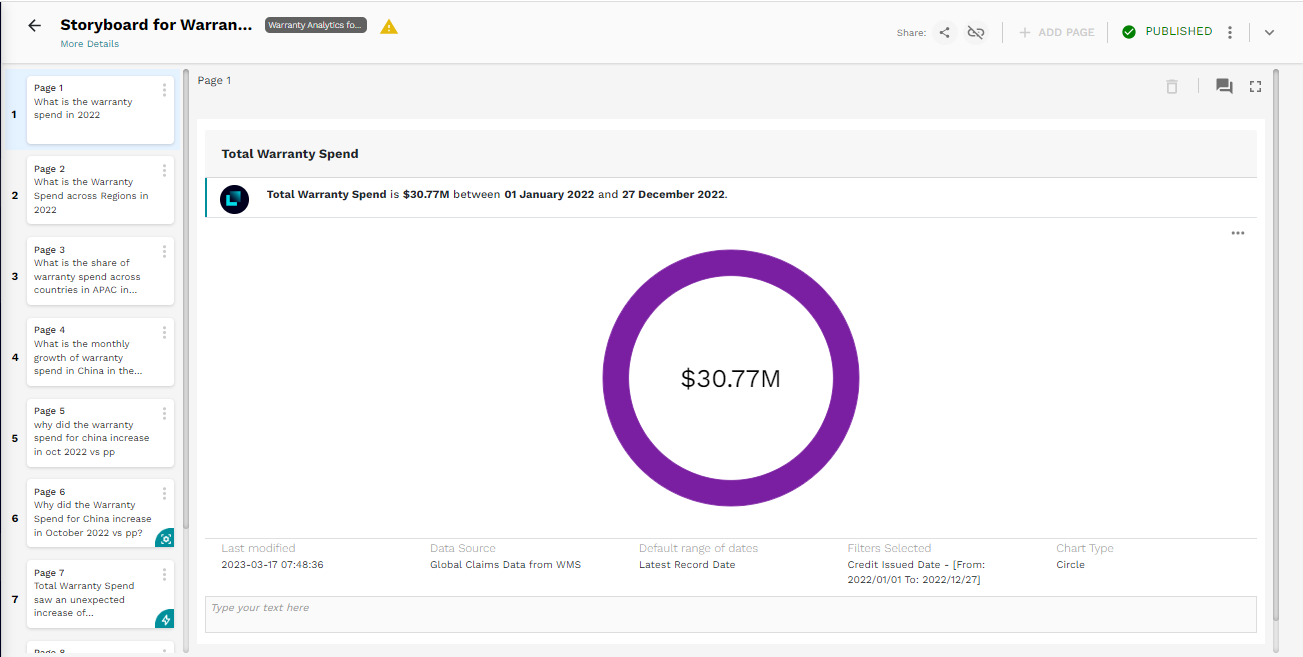

What was the warranty spending in 2022?

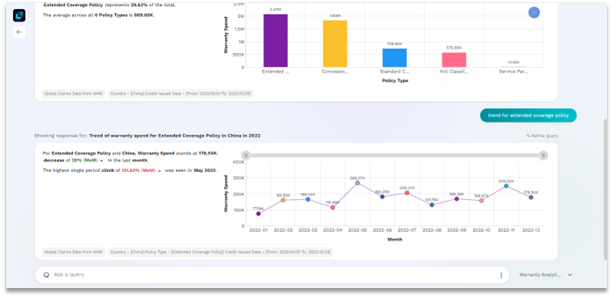

Lumin understood our question in natural language and converted it into an analytical query that included the time filter. As seen in Image 2, the warranty spending in 2022 is $ 30.77M. Now that we know the amount spent on servicing warranty claims in 2022, it would be interesting to understand its spread across the different operating regions. As a business, looking out for regions with significant warranty outlay is important.

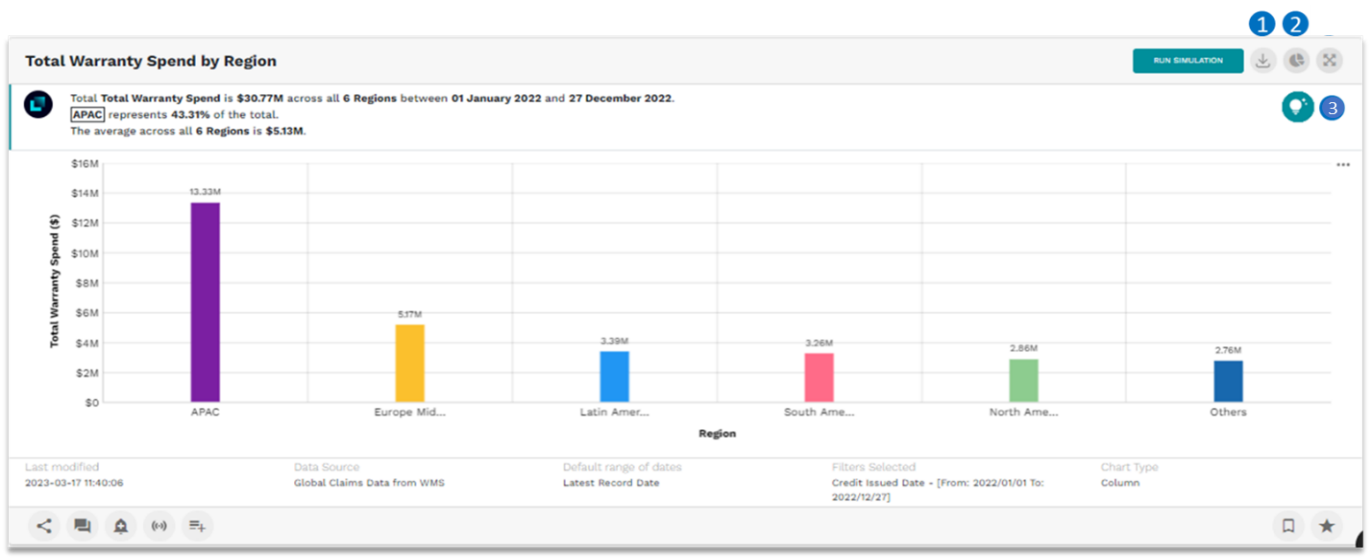

What was the warranty spending across regions in 2022?

Lumin allows us to:

- Export the underlying data

- Flexibility to switch the chart visualization

- Better navigate our insights exploration through the connected insights

As you can see in Image 3, Lumin dynamically selected the best-fit visualization to present the insight while generating a contextualized narrative (in English) to explain the same. It is evident that APAC has contributed to nearly half of the global warranty spending, which is interesting.

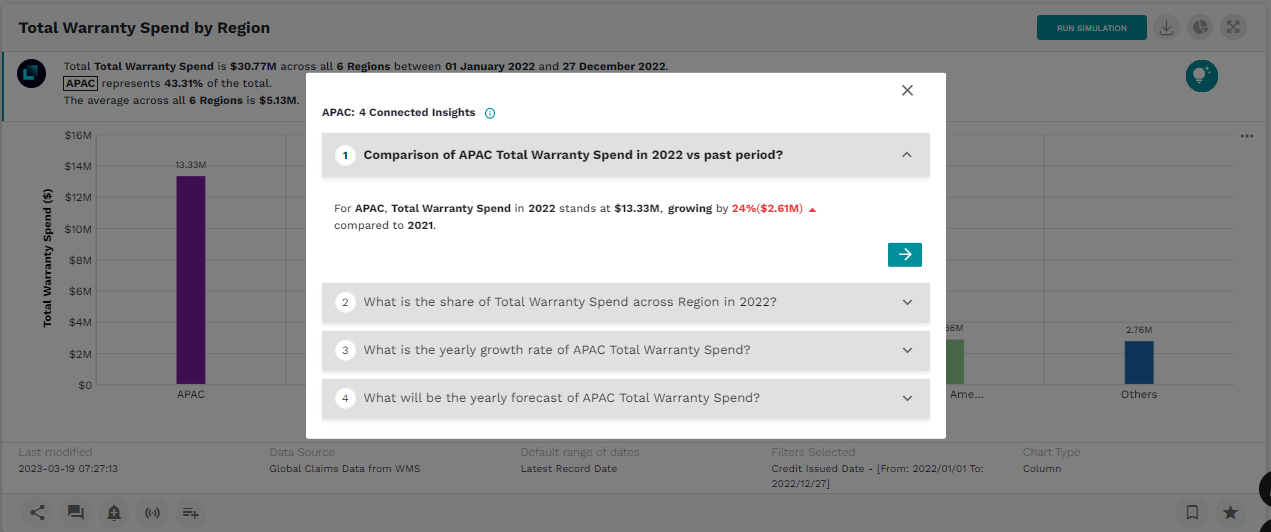

On clicking the connected insights button in Image 4, Lumin provides a set of simple and advanced analytical questions closely related to the metric or KPI we are exploring. As you can see in Image 4 below, Lumin has proactively nudged us on the increase in warranty spending for APAC in 2022 versus the year ago, which makes the case for APAC more intriguing. Similarly, we can explore other insights (and navigate to a detailed visualization and narrative) that Lumin has suggested.

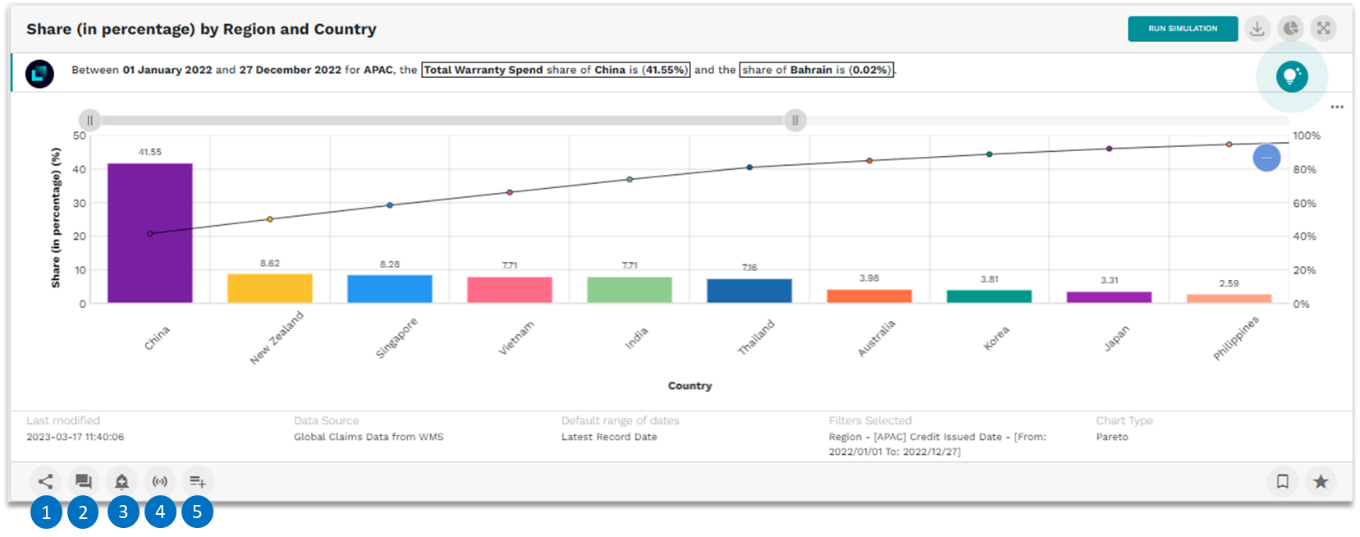

As the next logical step, it would be prudent to identify the countries within APAC that have had the highest share in warranty spending. We can ask Lumin the following question.

What was the share of warranty spending across Countries in APAC in 2022?

I would expect Lumin to show me a Pareto chart. It does exactly that. Lumin’s semantic model understands common business terminologies like ratio, share, contribution, top or bottom N, etc. It does not need to be trained separately on these. As is evident from Image 5, China leads the pack of countries within APAC in warranty spending. It has an almost 40% share.

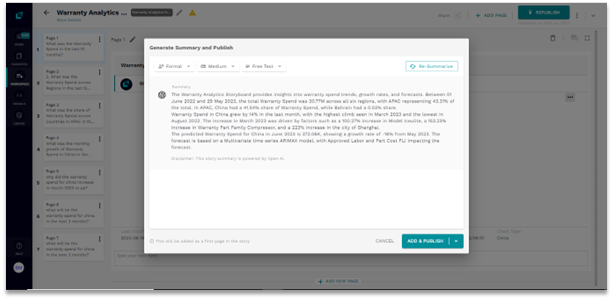

Lumin provides us with some powerful collaboration features that allow us to:

- Share the insights with our colleagues within the organization

- Add comments (our understanding, observations, POV, etc.)on the insights while we collaborate with a larger team

- As seen in Image 5, one can create personalized alerts and signals to better track the metrics or KPIs, and get notified when they breach a threshold that we can define

- Capture the insights in an insights storyboard called a workspace as we go about our exploratory journey. The workspace can further be shared with our colleagues within the organization

Since we know China had the highest share, the next obvious question would be: Has warranty spending grown M-O-M in 2022 or were there certain months where we have seen an unexpectedly high spending? To answer this, we can ask Lumin.

What was the monthly growth of warranty spending in China in the last 12 months?

The insight in Image 6 suggests that the warranty spending has oscillated in the $300K to $ 700K range. However, a few months, like June or October, witnessed a sudden increase in warranty spending compared to the previous month. As per Lumin’s Natural Language Generation (NLG) narrative, the highest M-O-M rise was witnessed in October 2022.

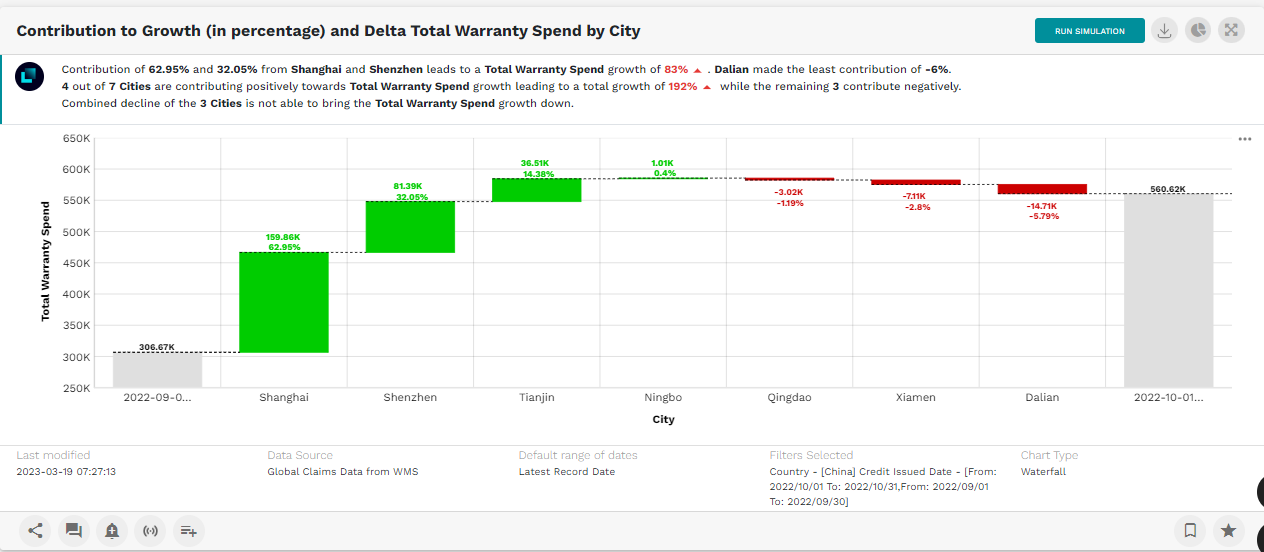

With this information, wouldn’t it be interesting to know which cities within China contributed the most to that increase in warranty spending in October 2022? Let us ask Lumin.

What contributed to the growth of warranty spending in China across cities in Oct 2022 vs. Sep 2022?

As evident from the waterfall chart in Image 7, Shanghai, Shenzhen, and Tianjin have driven the increase in warranty spending in China in October 2022. Shanghai leads the pack with an almost 2/3rd increase in October vs. the previous month.

Never miss a critical change in your warranty spending with autonomous nudges

We can continue even further and ask even more questions. We can probe the data for more deep-dive analyses across various dimensions. We began our analysis by looking at APAC’s geographical cut. Beyond this, we can look at products and models, policy types, claim types, etc., and arrive at granular insights enabling increased confidence in enterprise decision-making.

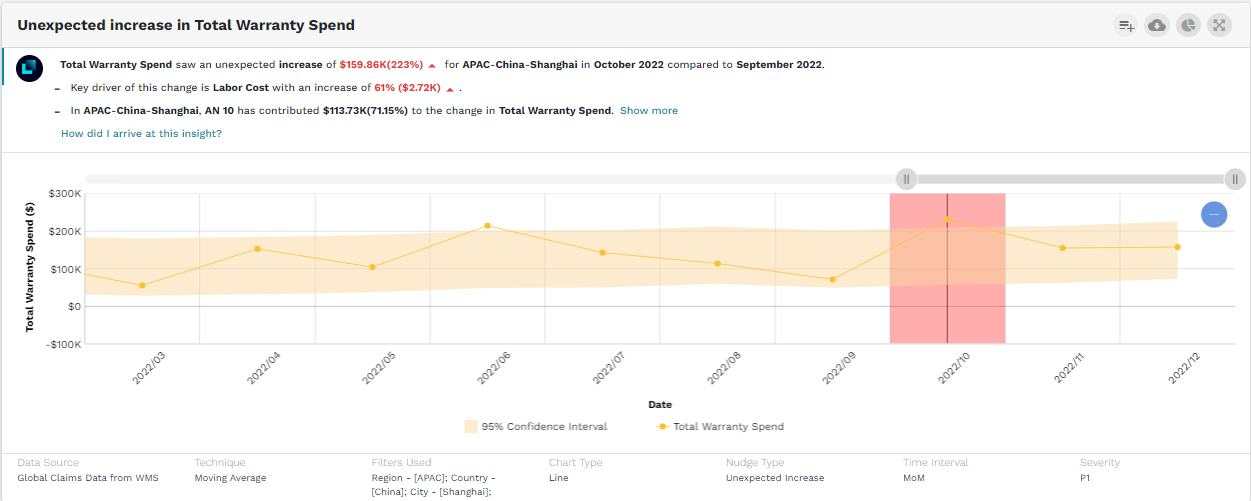

Still, what if Lumin could have autonomously detected and nudged us on anomalistic trends? Could this have been possible? Yes, Lumin can spot deviations in our data as they happen with fully automated ‘nudges.’ Lumin’s anomaly engine synthesizes millions of data points in seconds to inform us of important changes as they happen. It detects what had shifted, when, why this occurred, and by how much.

In this sample use case, we set up autonomous nudges on warranty spending. We configured it to look for anomalistic behavior in warranty spending across the geographical hierarchy comprising regions, cities, and service centers. Lumin proactively detected the sudden increase in warranty spending in APAC-China-Shanghai, as seen in Image 8. It also pointed to the fact that an increase led to the growth in labor. The growth was witnessed particularly at account 10 (AN10) in Shanghai.

As you can see in Image 8, autonomous nudges, leveraging machine learning, proactively surfaced the anomaly for which we had to otherwise ask multiple questions on Lumin.

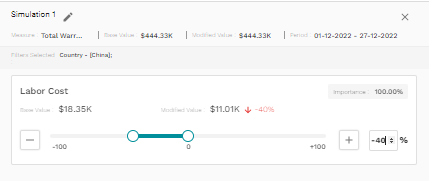

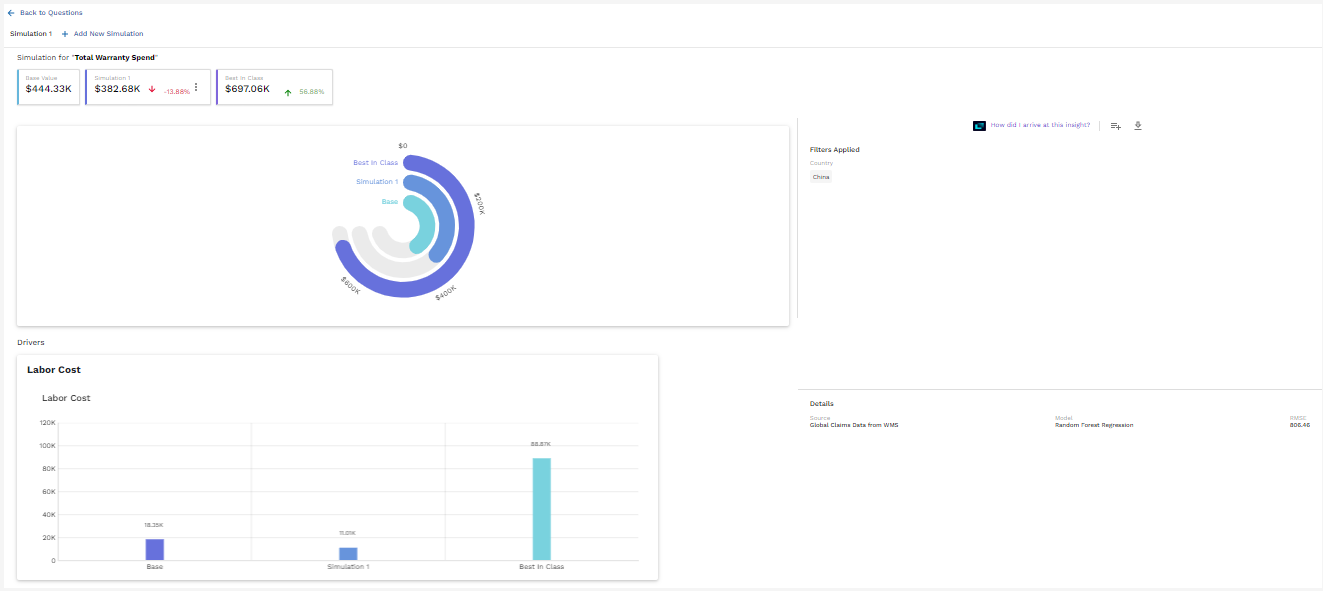

Go beyond insights to reveal the “why” and “what if”

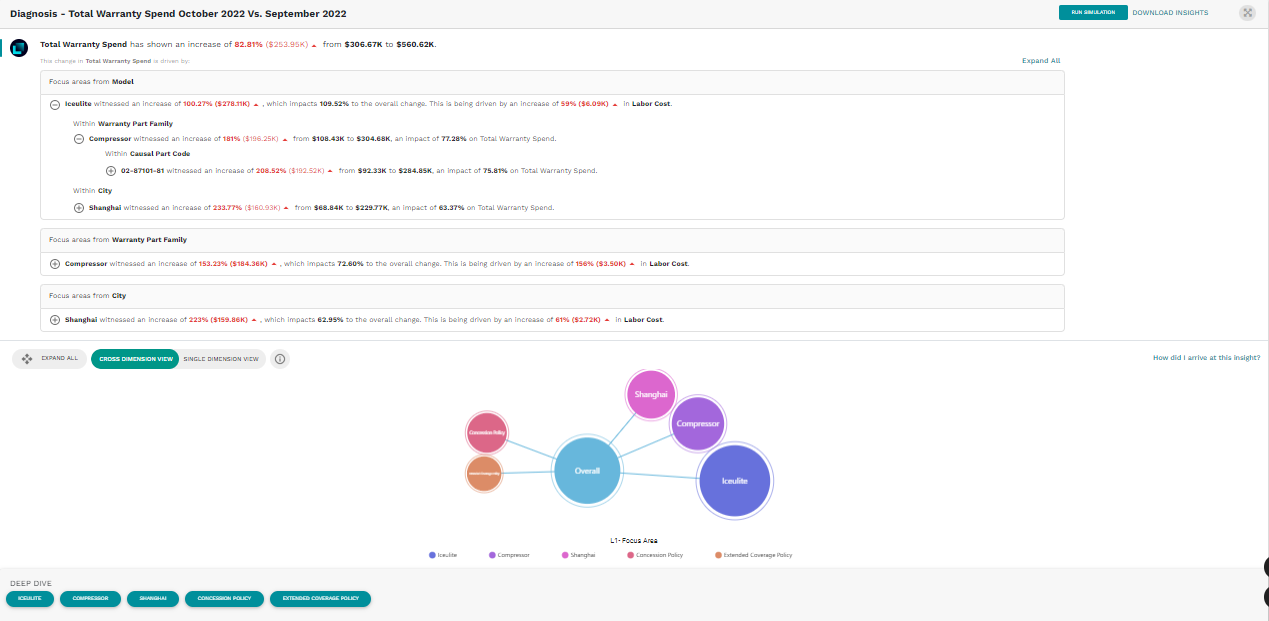

We discussed earlier that one of the ways to analyze the increase in warranty spending in China is to cut the metric across various dimensions and hierarchies. This will require us to ask multiple questions and take a lot of time. This problem makes the process inefficient. However, we can diagnose the reason for the increase by asking a single “Why” question to Lumin.

Why did the warranty spending for China increase in October 2022 vs.PP?

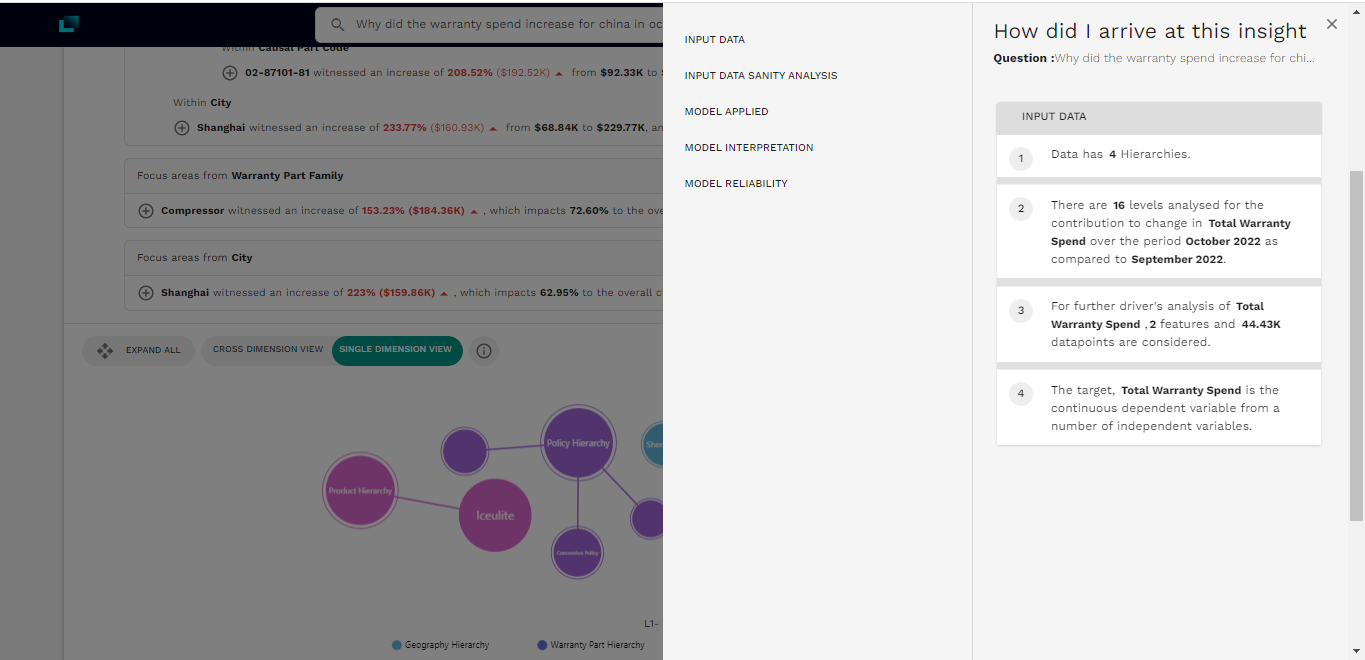

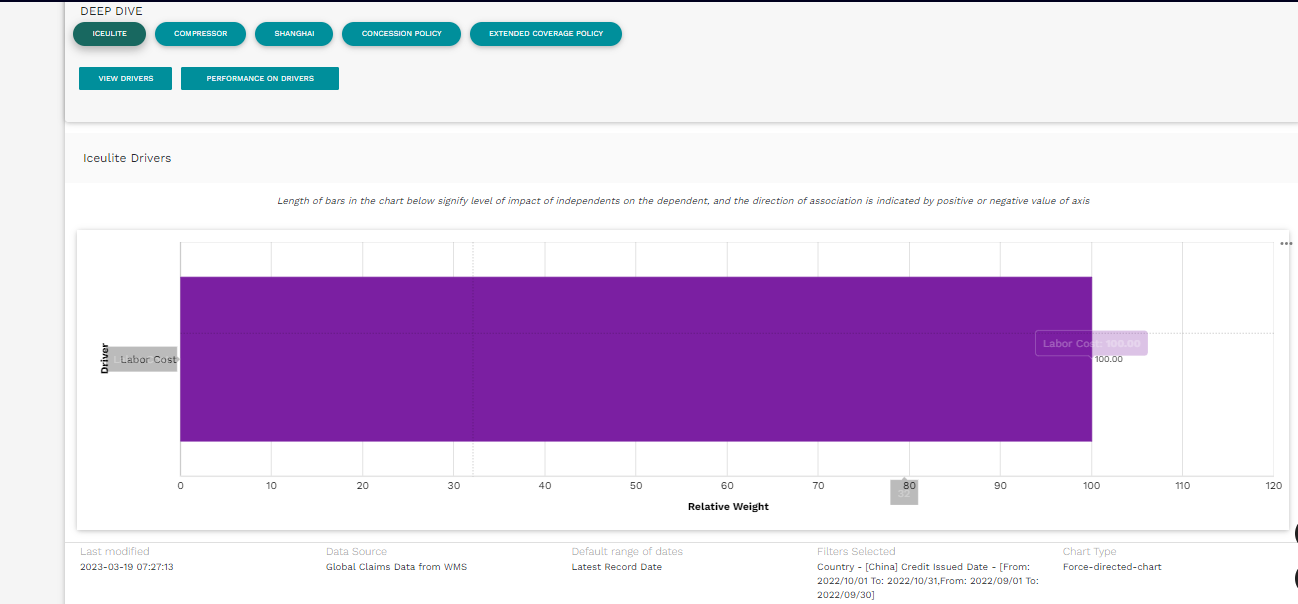

As seen in Image 9, Lumin performs a cross-dimensional analysis of warranty spending. This analysis included the:

- Product hierarchy (product, model)

- Policy hierarchy (policy type, claim type)

- Warranty part hierarchy (part family, part code)

- The geographical hierarchy that we have already analyzed